Electronic remote online notary (RON) closings are soon to become the new normal in Michigan. As a Realtor, if you haven’t been experimenting with them, you’re not partnered with the right team of professionals. There are two prerequisites to making this offering to your customer - which is an offering of convenience.

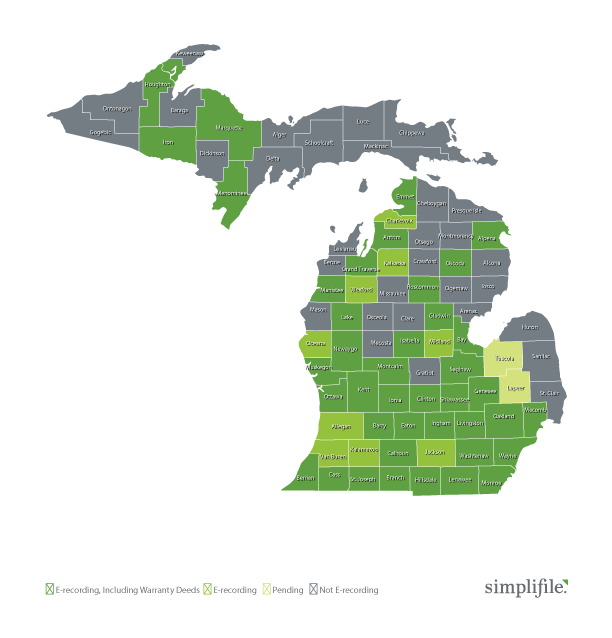

(1) The County where the property is located must fully e-record both deeds and mortgages. Most counties first adopt and allow mortgages to be e-recorded and later add deeds, as e-recording deeds requires tax certification by an office down the hall, the County Treasurer, which may require additional training, software, etc. The map below provided by Simplifile depicts in dark green those counties in MI they have boarded that record both deeds and mortgages. Light green depicts recording of mortgages only. Gray records neither. If you do business in a light green or gray county, you need to voice to that County’s Register of Deeds your desire for them to fully e-record deeds and mortgages so that you can participate in RON closings. If they know there is a demand for it, it may move its way up the priority ladder quicker.

(2) If there is a Lender involved in the transaction, they must agree to having their documentation signed electronically. Currently, some do and some don’t. But they are progressing in that direction. Much of their hesitation involves whether or not they need a paper note with ink - or if their organization is technologically advanced enough to utilize an e-note and an e-vault where their electronically signed note is securely transferred and sold almost immediately to the secondary mortgage market post-closing. Some lenders may portfolio their loans or it may be an in house commercial loan and they may not be concerned with this. We’ve developed hybrid closings to accommodate all facets. Perhaps we close electronically with a seller only because the lender is not in a position to close electronically. Perhaps the lender will allow everything to be signed at a RON closing, but would like to paper out the note. There are many variables and lots of options.

I’ve been in this business for over 36 years and there is a huge paradigm shift happening in the way we conduct closings. I compare offering the convenience of a RON closing to a customer -vs- a round table closing to this: Would you rather drive an hour in a snow storm and walk through a mall for several hours looking for a product - which you may or may not find, and then take an additional hour to drive back home- OR would you rather go home after work, log in to Amazon.com - find the product it - read the reviews - order it - and have it appear on your door step the next day - free shipping? When a customer is given the choice of a RON closing - they have the convenience of first reviewing the documents electronically, getting their questions answered, then logging on to their computer in the convenience of their own home and setting up a signing on demand, 24/7. Gone is the day when we need a buyer or seller to take time off work, travel, fight traffic and find a parking spot, just to put ink on paper. With 45% of the mortgages in 2018 having been executed by millennials, and the prediction that they will comprise 50% of our workforce by next year alone, be prepared for the question - can’t I just do it on my phone? You need to stay ahead of the curve. Ready or not, this is the future.

Please contact CSS if you are interested in testing the waters with your first RON closing.